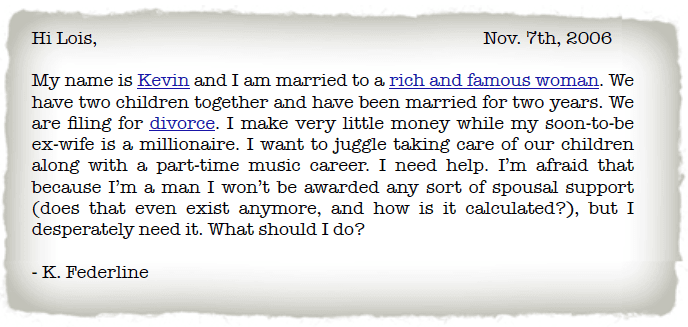

This is, of course, not a real letter and certainly not from the real Kevin

Federline, but I get questions like this all the time from husbands and

wives wondering how they’ll be able to support themselves after

going through a divorce.

This is, of course, not a real letter and certainly not from the real Kevin

Federline, but I get questions like this all the time from husbands and

wives wondering how they’ll be able to support themselves after

going through a divorce.

So what exactly is “spousal support” and how does it work?

Spousal support is known as spousal maintenance and has been referred to in the past as “alimony.” During the course of a divorce proceeding, it is awarded to the spouse (male or female, and in New York State this includes same-sex couples) who is financially dependent on the other spouse during the course of the marriage. Spousal support can be awarded on a short-term or lifetime basis (often half the length of the marriage) but is generally given for rehabilitative purposes (so the lower income spouse can go get their MBA or their Ph.D to give them a better opportunity to earn a higher salary). Spousal support is tax deductible for the payor and is taxable income for the recipient.

- Not to be confused with temporary alimony or temporary spousal support, which is awarded only until a divorce is finalized. Temporary spousal support in New York is subject to a specific formula while traditional spousal support is not. Temporary spousal support is set at 30 percent of higher-income spouse, less 20 percent of the lower earning spouse’s income.

Awarding spousal support is not as clear-cut as something like child support. The amount of money awarded is often subjective with the judge. And many different factors come into play when awarding spousal support.

- Length of the marriage

- Earning capacity of each party in the divorce

- Earning impairment for one or both parties in the divorce

- Property and whether it was acquired by one or both parties before or during the marriage

- Income of both parties

- Prenuptial and postnuptial agreements

- The lifestyle maintained by both parties during the course of the marriage

Because there are so many combinations and permutations of the aforementioned factors that affect spousal support, fighting over it can become costly and drawn out—in some cases for years after the divorce. In the court of law, you are essentially at the mercy of a judge who could have gone through a messy divorce themselves and who may have a biased opinion when it comes to the subject of how much spousal support you deserve.

Negotiating the spousal support award with a professional divorce mediator is a much better idea than going to court because it allows for a solution that is in the best interests of both parties. For example, because there are tax implications with spousal support, both parties in the divorce can work with a mediator to review their expected income along with the distribution of their marital property to find a tax-friendly resolution that makes sense for everyone.

With spousal support and divorce, there always numerous question-marks and concerns. But with proper counsel and support there is always a solution.